Blog

Home » Diamonds blog » SUSTAINABILITY A KEY FACTOR INFLUENCING DIAMOND PURCHASES INDICATES LARGE-SCALE STUDY BY DE BEERS

Focus on

Research commissioned by De Beers Group in 2022 and reported upon in its recently released Diamond Insight Report confirms that sustainability remains a key consideration for consumers, and is having a tangible impacts on their purchasing decisions.

The study was conducted among more than 18,000 women in the United States, but also includes information from other markets.

According to the report, consumers are increasingly conscious of the environmental and social ramifications of their purchases, with values are becoming the new markers of status in luxury.

Whereas previously a product’s origin, like French Champagne and Italian leather, was a marker of status and value, increasingly, it is how products are sourced and what a brand stands for that are driving value differentiation. Consumers want to align their purchases with products and brands that indicate to others their own values and priorities, the report states.

“This presents an immense opportunity for the diamond industry,” the Diamond Insight Report notes. “With its decades-long track record of creating meaningful and lasting socioeconomic benefits for the people and places where diamonds are discovered, the industry has a compelling platform on which to engage with a new generation of consumers whose priorities extend beyond the traditional considerations of price, quality and design.”

Source: De Beers’ Diamond Insight Report 2022

DIAMONDS BENEFITING SOCIETY

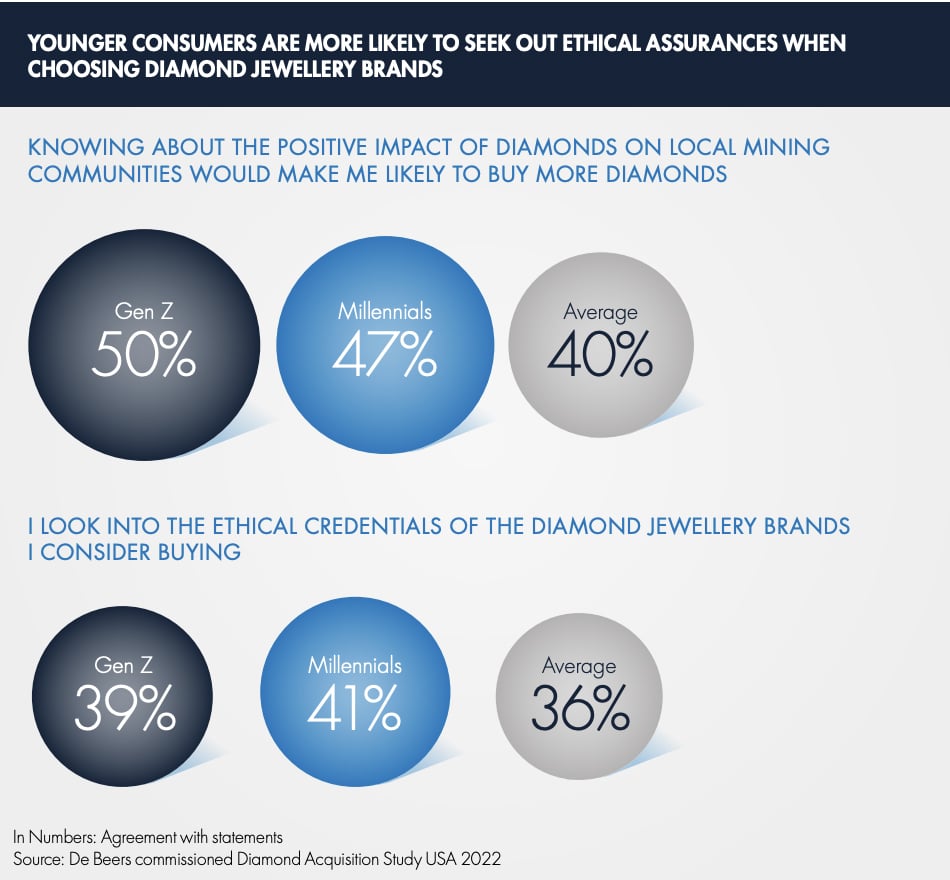

The research indicated that, beyond environmental and social sustainability, trusting ethical business practices behind a diamond’s journey to retail is increasingly important, 36 percent of the women polled indicating that they look into the ethical credentials of the diamond jewelry brands they are considering purchasing and 51 percent saying they would not buy diamonds if they knew they were not ethically sourced.

Some 40 percent of women say that knowing about the positive impact of diamonds on local mining communities would make them more likely to buy diamonds.

It is younger consumers who are more likely to seek out ethical assurances when buying diamonds and many already understand that diamonds benefit the nations where they are sourced and processed, the report says. In the United States, 49 percent of women overall fall into this category, and awareness is higher among Gen Z, standing at 52 percent, and Millennials, where 53 percent demonstrate such awareness.

Regarding the the specific ESG factors that play a role in consumers’ choice of diamond brands, the two most influential factors for American women are preserving wildlife around diamond mines and sourcing from conflict-free zones.

In China the figures are lower. Some 22 percent consider ethical and ESG factors when choosing diamond brands, which include worker welfare, impact on the environment and a transparent supply chain. For Gen Z Chinese consumer the figure rises to 28 percent.

The 3Ps ALONGSIDE THE 4Cs

Provenance has been a focus for the diamond industry for almost two decades, but the war in Ukraine has heightened interest, the Diamond Insight report states. One in five Americans are now more likely to look for the origin of diamonds and about one in 10 are more likely to buy diamond jewellery from reputable brands.

While it has long been common for purchasers to request grading certificates to indicate the gemological quality of diamonds, there is a gathering momentum for certificates of diamond origin. Some 27 percent of new diamond acquisitions coming with such certification in 2021.

The diamond industry has been developing provenance programs for some time already, frequently powered by new technologies such as blockchain. Such programmes can give retailers – and consumers – the confidence they require.

“In the next decade, the 4Cs will be complemented by the 3Ps – provenance, purpose and partnership, stated Marc Jacheet, CEO of De Beers Brands. “Where provenance becomes key – both as a sign of quality and through end-clients wanting to know they are part of a story that creates positive impact for people and the planet.”

Provenance programmes could be key in informing consumers about the positive impact their diamond has helped create on its journey to them, the report notes. “In doing so, diamond jewelry brands have a significant opportunity to respond to the consumer desire for this information and drive value differentiation by bringing a diamond’s story to life through digitally enhanced storytelling,” it states.