ROUGH SUPPLY TO STAGNATE, WHILE DEMAND RISES

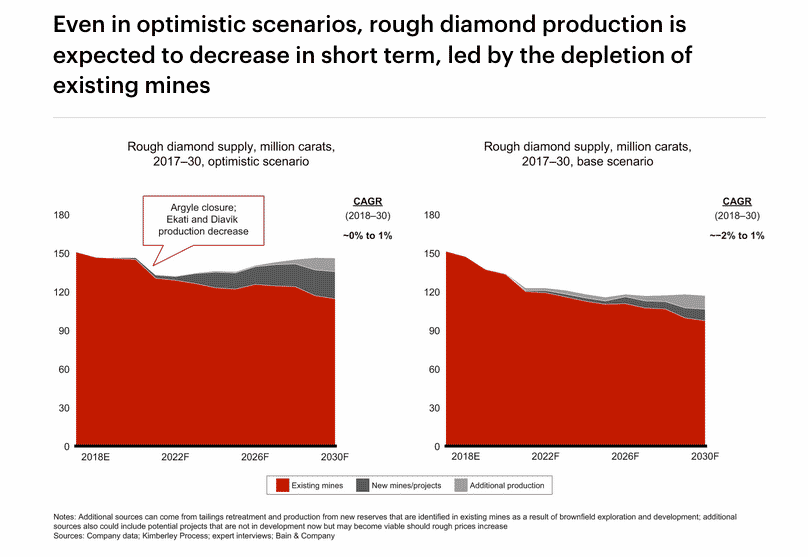

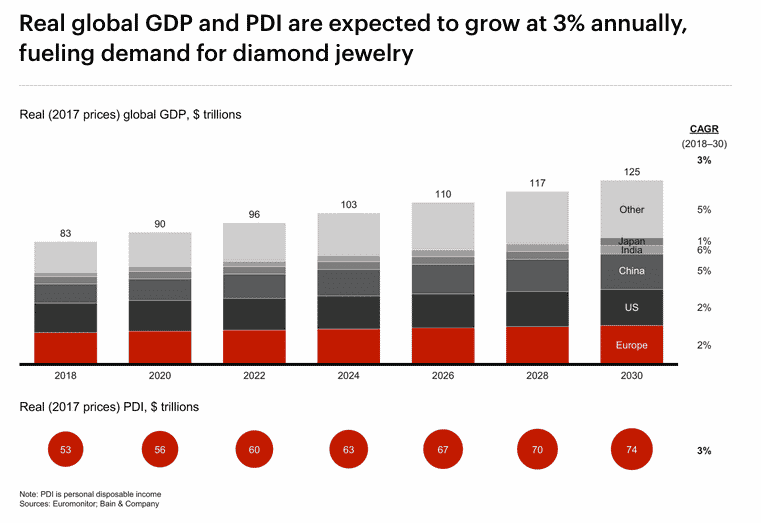

The long-term outlook for the diamond market remains positive, Bain notes. While rough diamond supply is projected to hover about 1 percent real growth and 1 percent negative growth annually in volume terms, demand for natural rough diamonds could grow up to 2 percent annually through 2030 in real terms, or 2 percent to 4 percent in nominal terms.

While rough diamond supply will be reasonably predictable over the coming five to ten years, the Bain report states, financial challenges, production mix updates and overall uncertainty over future market conditions could force or delay production.

The report’s authors say that they based their rough diamond supply forecast on an analysis of existing mines and anticipated production at planned new mines. Their projections also include potential supply from new sources, such as tailings from older mines, reopening of distressed mines, activation of options in resource development plans and recycling of secondhand diamonds.

According to the report, already announced new projects could add up to 21 million carats per annum in rough diamond production. However, even in the most optimistic of scenarios, rough diamond production is expected to decrease in the short term, led by the depletion of existing mines.