There are a number of off-beat records listed by Guinness pertaining to diamonds. These include the most diamonds set in a handbag, a toilet seat, a perfume bottle, cellphone and lipstick case.

YOU ARE CORDIALLY INVITED TO JOIN US AT THE GEMGENE’VE SHOW 2025

MID’s exhibition booth (E-33) will be greeting buyers from all over the world. MID House of Diamonds will be among the exhibitors at the GEMGENÈVE SHOW.

Come say Hi at Booth: E-33.

MID House of Diamonds will be among the exhibitors at the June 2020 JCK Vegas Show. Come say Hi!

Lorem ipsum dolor sit amet conse ctetur adipisicing elit.

Ipsum dolor sit amet conse ctetur adipisicing elit, sed do eiusmod tempor incididunt.

Dolor sit amet conse ctetur adipisicing elit, sed do eiusmod tempor.

580 5th Ave #3003, New York, NY 10036

+1-212-391-1121

+1-877-391-1121

Home » Diamonds blog

Discover

There are a number of off-beat records listed by Guinness pertaining to diamonds. These include the most diamonds set in a handbag, a toilet seat, a perfume bottle, cellphone and lipstick case.

De Beers has reported a strong first six months of the year, with revenues increasing to $3.6 billion, up from $2.9 billion in 2021. This it said came as the midstream of the diamond pipeline replenished stocks following healthy consumer demand over the holiday season.

During the 17th century, Golconda was the world’s primary producer of diamonds. Some 38 mines were active in the sultanate, with total output estimated to be around 12 million carats.

A massive rough pink diamond, weighing about 170 carats or 134 grams, has been discovered at the Lulo alluvial diamond mine in Angola. Called the Lulo Rose, it is the fifth largest diamond recovered at the site to date.

A recent study conducted by the U.S.-based Luxury Institute, which looked at whether experts felt the current economic slowdown in luxury is turning into an economic downturn or a full recession, has provided a set of polarized opinions.

The long-used system by which diamond companies would cherry pick what stones to send to be graded, sometimes selecting the lab according to the type of merchandise concerned, is becoming archaic. To an ever-greater degree, almost every diamond being put out into the market requires some type of report.

The Kimberley Process has released global rough diamond production totals for all of 2021, and while they indicate a general recovery to the levels that existed before the onset of the COVID pandemic, they also suggest that a trend of lower rough diamond production that was already evident latter part of the last decade has continued.

While there is an inflationary climate and lagging consumer confidence in the critically important U.S. market, jewelry sales in the country continued to surge. According to Mastercard SpendingPulse,

jewelry purchases far outpaced most other categories, rising 87 percent over the corresponding period in 2019.

Concern about the environment, in part driven by global warming and climate change, is likely to have a profound impact on the luxury product industry and on the policies of companies operating in its space. This is a one of the key findings of a report, entitled “Luxury Outlook 2022,” released by the Boston Consulting Group (BCG) and Comité Colbert.

Once considered a marginal competitor in the jewelry market by its considerably larger natural diamond counterpart, laboratory-grown diamonds are rapidly gaining in popularity among consumers, and even making inroads in the critically important bridal jewelry sector, writes the noted Israeli diamond analyst, Edahn Golan, in a recent article entitled “Lab Grown: All Fears Materialized.”

The rough diamond mining sector is due for a shakeup, with some of the perennial major producers, like Australia, seeing output dwindle, and Russia, which for the past several years has led the pack along with Botswana, having its route the market restricted at best, because of the sanctions brought against it after its army invaded Ukraine in February. But one producer whose star clearly is rising is Angola.

After the worst dip in its history in 2020, a direct result of the COVID pandemic that broke out early in the year, the personal luxury goods market experienced a V-shaped rebound in 2021, reaching €288 billion in value, according to Bain & Company, in its Luxury 2022 Spring Update – “Rerouting the Future.”

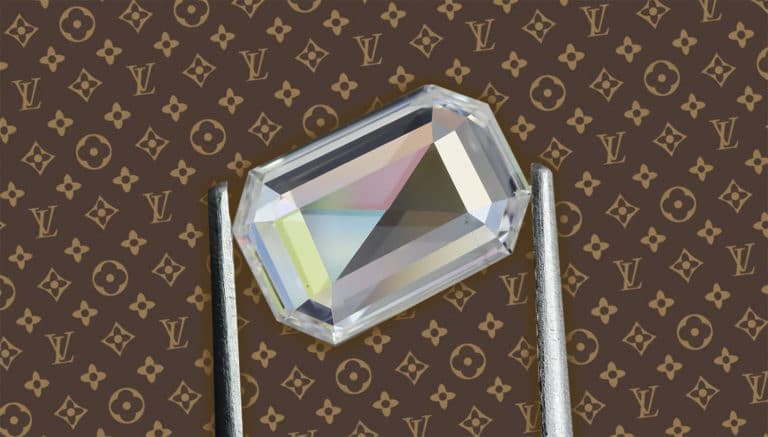

The recent announcement by LVMH, the world’s largest luxury brand house, according to which it would be directing funds of an undisclosed value from its investment arm, LVMH Luxury Ventures, into an Israeli laboratory-grown diamond startup, may well be regarded as a giant step in the journey that the synthetically produced diamond industry has been taking in obtaining wide-spread acceptance.

The recent announcement by LVMH, the world’s largest luxury brand house, according to which it would be directing funds of an undisclosed value from its investment arm, LVMH Luxury Ventures, into an Israeli laboratory-grown diamond startup, may well be regarded as a giant step in the journey that the synthetically produced diamond industry has been taking in obtaining wide-spread acceptance.

The focus of the high-end jewelry market shifted to New York in June, with a series of major auctions being held at which several large and unusual diamonds were on offer. Most probably the most well-known of them was a pear-shaped 101.41-carat, D-color, internally flawless stone called the Juno, which went on the block at Sotheby’s on June 16.

2021 proved to be a spectacular year for the diamond jewelry industry with sales at retail equaling $85.55 billion, and almost 60 percent of them, or $51.23 billion worth, registered in the booming U.S. and Canadian markets, according to the just-published TACY Diamond Pipeline Report prepared Pharos Beam Consulting, and authored by Pranay Narvekar and Chaim Even Zohar.

With Alrosa supplying some 30 percent of the rough goods flowing into the prior to the start of the crisis, and a substantially higher percentage of the smaller sized goods, it would be a unreasonable not to assume that the market would not be impacted – both in the short and long terms. But the effects are not straightforward, nor are the solutions being sought to cope in the marketplace.

With the JCK Show-led jewelry week underway in Las Vegas, quite possibly signaling the first full return to a semblance of normality since the onset of the COVID pandemic in 2020, the focus has shifted firmly to the U.S. consumer market, where once again the fortunes of the industry will rest.

As the United Kingdom and the British Commonwealth celebrate the 70th anniversary of the accession to the throne of Queen Elizabeth II on February 6, 1952, it’s sensible to pay tribute to the single individual who over an unbroken seven decades has possibly done more than any other to spotlight the beauty of the diamond in jewelry.

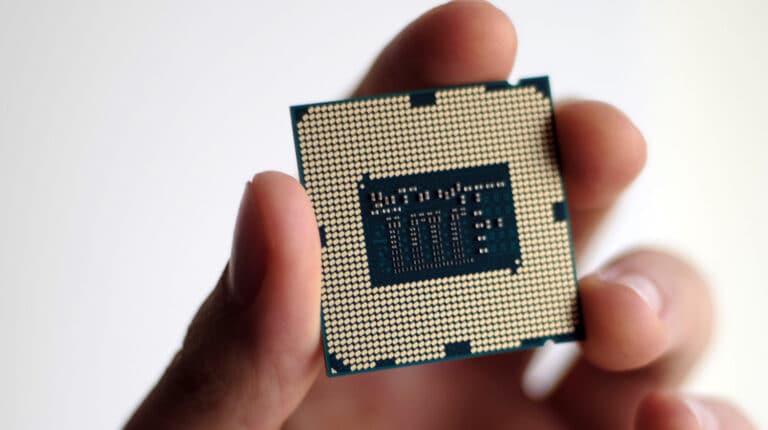

The ability to synthesize high-quality diamonds to meet the electronic industry’s requirements are creating a new reality, whereby diamond demand will also be driven by industrial need, and the jewelry sector will need to compete for material. Unsurprisingly, it is the computer sector that has the highest vested interest.

The celebrity couple Joaquin Phoenix and Rooney Mara caught jewelry aficionados’ attention in 2019 when their engagement to get married was revealed. Mara, who is known to be both minimalist and avant-garde, was seen defying convention by wearing an unflashy hexagon-shaped portrait-cut diamond, set between slender baguettes on a platinum band.

The economic impact of the policy is substantial, especially if one considers that we are referring to the world’s largest producing country and its second largest consumer economy. For the luxury industries, for almost two decades the China has also been the engine for a period of almost uninterrupted growth. Could that be coming to an end?

Three months since the start of the Russian invasion of Ukraine and the ramping up of the international economic sanctions regime against the Russian government and business sector, very little information about their impact has been released by the country’s dominant diamond producer, Alrosa.

As has been the case for 30 years now, with the exception of 2020 when it was canceled because of the COVID outbreak, the jewelry world will descend on Las Vegas next month for the JCK Show. And in contrast to 2021, which was a subdued affair attended mainly by Americans, expectations are high that this year things will return almost to normal.

For many in the luxury product industries, the Chinese consumer remains the knight on the white horse, spending more on luxury goods at home, even while he or she is restricted from traveling abroad because of COVID-related restrictions. But analysts are warning that the Chinese juggernaut may be faltering, or at the very least struggling to maintain the type of growth that it has become used to.