Blog

Home » Diamonds blog » U.S. LAB-GROWN DIAMOND PRODUCER VALUED AT $1.8 BILLION, AS IT PLANS TO OPEN FACTORY WITH A MINE’S PRODUCTION CAPACITY

Focus on

Fidelity Investments, more commonly known as Fidelity, is Boston-based multinational financial services corporation that is one of the largest asset managers in the world, with $4.9 trillion in assets under management as of June 2020 and a combined total customer asset value number of $8.3 trillion.

If its development stays on schedule, the factory that Diamond Foundry is planning will have a capacity of about one quarter of that of De Beers. “This is the first time that this quality of diamond is produced at mining scale,” Martin Roscheisen, the firm’s CEO, told the Financial Times.

The Diamond Foundry has already raised a total of $315 million since its establishment in 2012, attracting a group of high-profile investors like actor Leonardo DiCaprio, Tony Fadell, former chief executive of smart home company Nest, and Mark Pincus, the founder of video game group Zynga. It currently has no debt and turned a profit in 2020.

INDIAN INDUSTRY LEADERS APPEAL TO GOVERNMENT

To meet the challenge of dealing with the massive surge in COVID-19 cases, India’s Gem and Jewelry Export Promotion Council, the country’s leading jewelry industry body, called on the government to provide further assistance to the critical economic sector.

In a letter to Nirmala Sitharaman, the federal Minister of Finance and Corporate Affairs, Colin Shah, GJCEP Chairman, noted that the rise in infections had led to partial restrictions and lockdowns in various districts of Maharashtra and other states in India, including Gujarat, home to the world’s largest cutting and polishing center of Surat.

Diamond Foundry’s laboratory-grown diamond plant.

“Just as the macroeconomic numbers point to a recovery in a particular month, there is another set of data spreading the gloom of downturn the very next month,” Shah wrote. “The gem and jewelry trade has also been impacted and the sector is reeling under a lot of uncertainty with closure of retail stores, restriction on travel and logistics, restriction on manufacturing capacity and number of employees coming to work to curb the spread of the pandemic.”

“It has been the endeavor of the business owners to put in place a policy for safeguarding the workers and the manufacturing staff,” he stated, adding that serious assistance from the government is required upon to avoid any defaults and overcome the period of the crisis.

The GJEPC has requested the government consider a number of measures to limit the economic fallout. These include and extension of export finance realization period, and extension of import payments, a rescheduling of loan terms, maintaining the status quo for credit ratings and more.

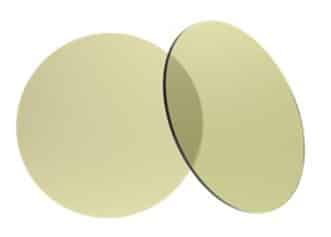

Single-crystal diamond wafers, which with their better heat conduction are growing in popularity in the semiconductor industry.

SEMICONDUCTORS AND WATCHES

The Diamond Foundry also sees tremendous opportunity in the electronics sector, where diamonds are replacing silicon because they are better good conductors of heat. They are expected to be in high demand with fast development of electric vehicles and 5G technology.

The laboratory-grown diamond producer is looking to expand into 200 millimeter single-crystal diamond wafers for use in semiconductors.

“All the largest technology companies in the world are looking at doing diamond wafers. It’s quite difficult to have full diamond for chips . . . we haven’t completely solved it yet,” Roscheisen told the Financial Times.

Another potential area of growth is the watch industry, which to date had been reluctant to us laboratory-grown stones.

But, as reported in a New York Times feature article, in February the French brand Barillet used lab-grown diamonds in its its Superpunk Diamants Lab Experience collection, on the heels of the giant Japanese brand Citizen, which last September revealed that they had been included in its L Ambiluna women’s watches. Citizen’s lab-grown were supplied by Swarovski, the Austrian crystal company, which inaugurated a lab-grown diamond production line in 2017.

However, as the New York Times article points out, the important but more conservative Swiss watch industry has yet to take the plunge. It is biding its time and keeping track of the market, which most indicators show is becoming more accepting of diamonds grown in a factory.

.