Blog

Home » Diamonds blog » Rough Diamond Production Falls in 2018, Value Slightly Rises

Focus on

The data provided by the Kimberley Process is generally considered to provide the most accurate picture of the state of the rough diamond market at any point in time, despite the fact that the primary function of the body is to prevent the infiltration of conflict diamonds into the legitimate pipeline. This because KP members, who collectively account for almost all diamonds produced and consumed each year, are obliged to provide the body with accurate production information, so that it can effectively monitor the flow of rough merchandise. No other international body has the same type of access to data from all around the world.

According to the KP, diamond production was down to 148.2 million carats in 2018, about 2 percent lower than where it had stood at the end of 2017. However, with the average price per carat rising from $93.60 to $97.50, the value of production climbed from $14.12 billion in 2017 to $14.47 billion last year.

PRODUCTION TOTALS OUTFLANK IMPORTS AND EXPORTS

But production figures differed somewhat from the value of rough diamonds being handled in the trading centers.

According to the KP, the total value of rough imports were down 3 percent in 2018 to $48.49 billion in 2018, while the volume fell to to 424.2 million carats, from 455.8 million carats in 2017.

In contrast, rough diamond exports decreased by 1 percent to $49.52 billion, while volume slipped by 6 percent to 428.6 million carats.

Unsurprisingly, the world’s largest rough diamond importer in 2018 was India, the country where more than half of all processed diamonds are cut and polished. Nonetheless, it saw rough imports cut by about 10 percent to $17.08 billion.

The world’s largest rough diamond importer in 2018 was India, the country where more than half of all processed diamonds are cut and polished.

At the same time, imports of rough goods into the European Union were up by about 0.5 percent to $12.25 billion. This is comprised almost entirely by goods flowing into the Antwerp rough diamond center.

LOWER SALES LIKELY TO BE REPEATED IN 2019

Figure are unlikely to improve in 2019, on the contrary. Provisional figures reported by De Beers for its fifth sales cycle of the year, which ended in late June. It saw rough allocations of sales of $390 million, which represented a decline of 6.3 per cent from its sales of $416 million in the fourth sales cycle of the year and 32 per cent year-on-year from the fifth sales cycle of 2018, when they had stood at $581 million.

“While overall retail sentiment for diamond jewelry in the U.S. remains solid, a more challenging environment in China and higher than normal polished diamond inventories in the midstream resulted in a cautious approach from rough diamond buyers during the fifth cycle of 2019,” said Bruce Cleaver, CEO of De Beers Group.

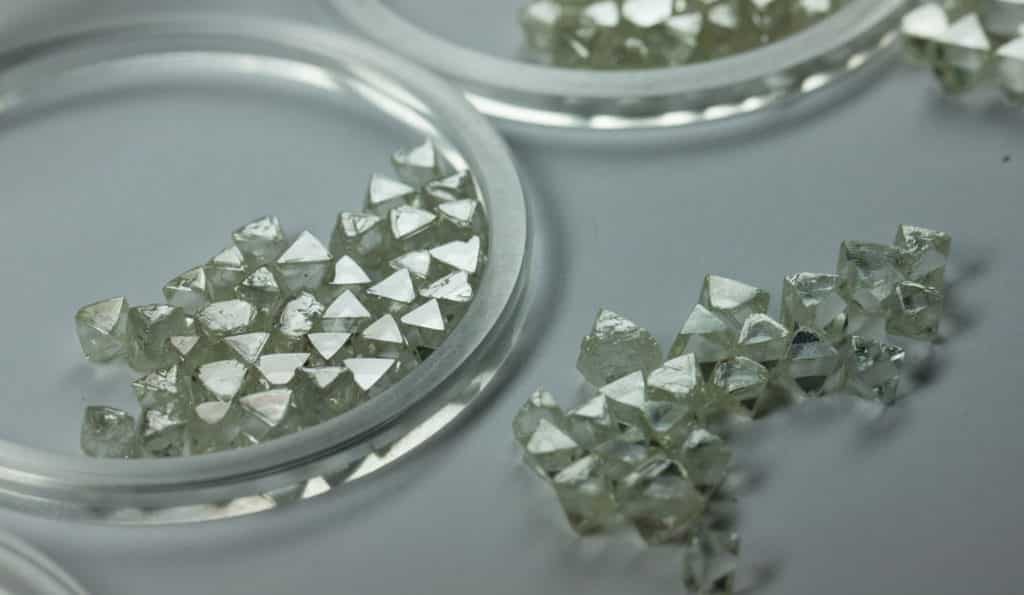

Photos of rough diamonds courtesy of Alrosa.

he situation in China, and in particular its trade war with the United States, has also been a cause of concern for Alrosa, the Russian diamond mining company which currently is the world’s largest producer of rough. “When there’s any political instability or tensions, luxury goods sales immediately react, including jewelry with diamonds,” said the company’s CEO Sergei Ivanov in an interview with the Financial Times. “We thought [our sales growth] in China would go up by 2 or 3 per cent, but now the outlook is likely more pessimistic — growth rates will either be neutral or slightly negative.”

Mr. Ivanov noted that sales, which fell 38 per cent year-on-year to $988m in the first quarter of 2019, and have continued to slump since, would continue to remain “much worse” than 2018 before improving in the fourth quarter this year.

“In the end, Christmas in the U.S. and Chinese New Year in February aren’t going anywhere. There’ll be good demand and the market will normalize,” the Alrosa CEO told the Financial Times.