Blog

Home » Diamonds blog » LVMH Poised for Full Recovery in 2021

Focus on

Photo courtesy of LVMH.

LVMH’s jewelry and watch division, which includes seven brands and 471 stores worldwide, accounted for $3.37 billion euro. With names like Chaumet, Fred, Bulgari, Tag Heuer, Zenith and Hublot, it always was a world leader. But it has now entered the stratosphere will the addition of possibly the brightest jewel of all, Tiffany & Co.

The COVID-1 pandemic did impact the watches and jewelry division hard, leading to a 23 percent decline in revenue in 2020. But that was tempered somewhat by the rebound in the Chinese market.

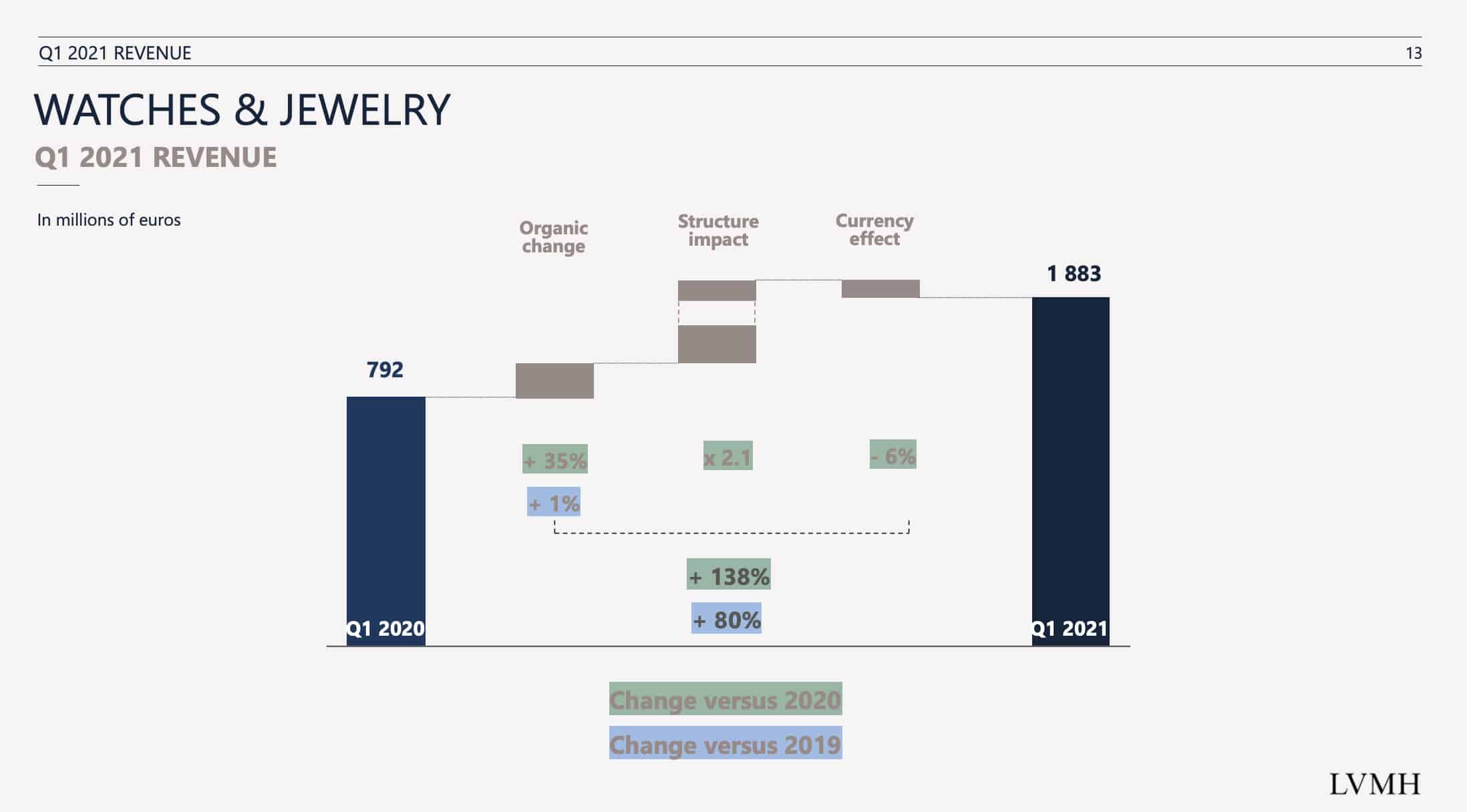

However, in its latest quarterly report, 2021 is showing an altogether different picture, with the markets rebounding strongly. During the first quarter of 2021, LVMH’s watch and jewelry division reported 1.88 billion worth of the revenue, 138 percent more than the 792 million worth that was registered during the same quarter a year earlier. The lion’s share of the increase could be accounted for by what the company described a structural impact, mossly related to its acquisition of Tiffany & Co.

RESULTS BEAT ANALYST’S FORECASTS

LVMH reported sales for the entire group of 13.96 billion euro in the first quarter 2021, which represents an increase of 30 percent from the same period a year ago, which it should be remembered started relatively normally before the pandemic forced the first lockdowns and store closures in most of the world. Indeed, sales were 8 percent higher than in the first quarter of 2019 before the pandemic hit.

Overall, the results were better than expected, with market analysts forecasting sales of about 12.6 billion euro, reported to FactSet data.

According to analyst forecasts compiled by Thomson Reuters, If LVMH’s first quarter trend stays on track, the company is expected to exceed pre-pandemic levels in 2021 – clearly a remarkable achievement just a little more than one year following the onset of the worst world global health crisis in more than a century.

During the first quarter of 2021, LVMH’s watch and jewelry division reported 1.88 billion worth of the revenue, 138 percent more than the 792 million worth that was registered during the same quarter a year earlier. (Photo courtesy of LVMH)

Click to enlarge*

It is worth noting that the luxury unit at Bain & Co., which is a usually the most carefully followed luxury market analysis authority, reported that worldwide sales of luxury products had contracted about 20 percent worldwide to around 217 billion globally in 2020, and that a recovery could take as much as two to three years. LVMH is apparently out to prove otherwise.

CHINA AND UNITED STATES LEAD THE WAY

The Chinese market, which by the second half of 2020 was largely out of lockdown, was able to take much of the credit for LVMH’s rebound. Travel in and out of the country remains very severely restricted, meaning that luxury product buyers that, for years had done much of their spending during trips abroad, were now being forced to concentrate their spending at home.

But, the United States, which is still in the midst of the pandemic, although its vaccination drive is a building up rapidly with more than 30 percent of the population having received at least one shot, is also seeing a string return to market activity.

LVMH expects the American contribution to it bottom line to improve, and it has sent a team of top executives to New York to integrate its new $15.8 billion acquisition into its operation.

What is evident with LVMH is apparently being matched by the world’s other luxury product giants.

Since LVMH shares have skyrocketed by 52 percent since the end of the second quarter of 2020, the share price of its rival the Richemont Group is up 54 percent, while Kering’s share price has increased in value by 30 percent. Among Richemont’s brands are Baume & Mercier, Buccellati, Cartier, Chloé, Dunhill, IWC Schaffhausen, Jaeger-LeCoultre, Lancel, Montblanc, Piaget, Purdeyand Van Cleef & Arpels. Among Kering’s brands are Gucci, Alexander McQueen, Boucheron, Pomellato and Girard-Perregaux.